What is a Public Adjuster's Role in Florida?

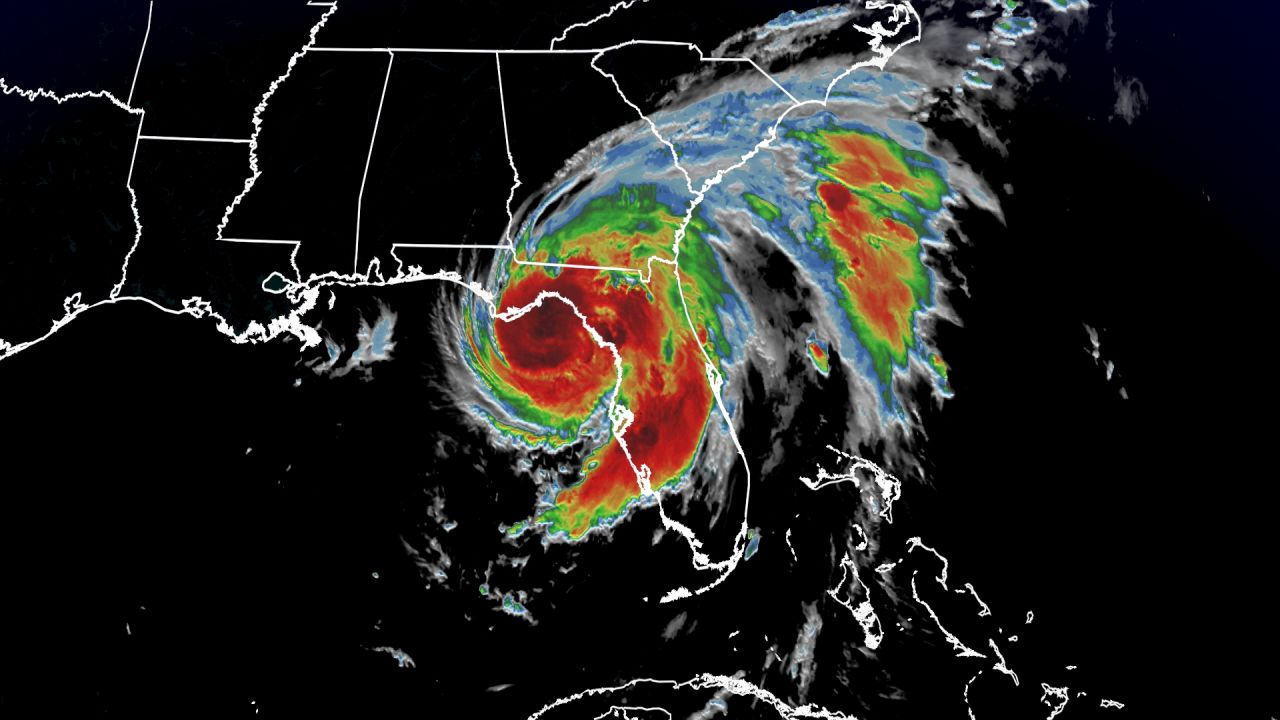

When a hurricane lands on the coastal cities or comes across the center of Florida, the damage can be devastating for Florida Residents. Homeowners and business owners often face extensive damage to their properties, leading to significant financial strain. Navigating the complex process of filing an insurance claim can add to the stress. This is when and where a trusted and respected public adjuster can be extremely valuable. A public adjuster is a licensed business person who strategically represents the policy owner in processing the needed insurance claims. Unlike insurance company adjusters, who work for the insurer, public adjusters work exclusively for the policyholder, ensuring that their clients receive the maximum compensation for their losses.

One of the primary benefits of hiring a public adjuster is their expertise in assessing and documenting damage. After a hurricane, the extent of the damage can be vast and varied, including structural damage, water damage, and loss of personal property. Public adjusters are licensed and go through tremendous training to perform thorough inspections and document all of the resulting damages. They understand the nuances of insurance policies and can identify coverages that policyholders might overlook. This comprehensive documentation is crucial in substantiating the claim and ensuring that all damages are accounted for.

Another significant advantage of hiring a public adjuster is their ability to navigate the complexities of insurance policies and negotiations. Insurance policies can be intricate, with various clauses, exclusions, and conditions that can affect the outcome of a claim. Public adjusters have the knowledge and experience to interpret these policies accurately. They can identify potential pitfalls and ensure that the claim is filed correctly and promptly. Moreover, public adjusters are skilled negotiators. They know how to present the claim effectively and negotiate with the insurance company to secure a fair settlement.

Public adjusters also play a crucial role in expediting the claims process. Filing an insurance claim can be time-consuming and stressful, especially in the aftermath of a hurricane when policyholders are dealing with the immediate impacts of the disaster. Public adjusters take on the burden of managing the claim, allowing policyholders to focus on recovery and rebuilding. They handle all communications with the insurance company, follow up on the claim's progress, and address any issues that arise. This proactive approach can significantly speed up the claims process and reduce the stress on the policyholder.

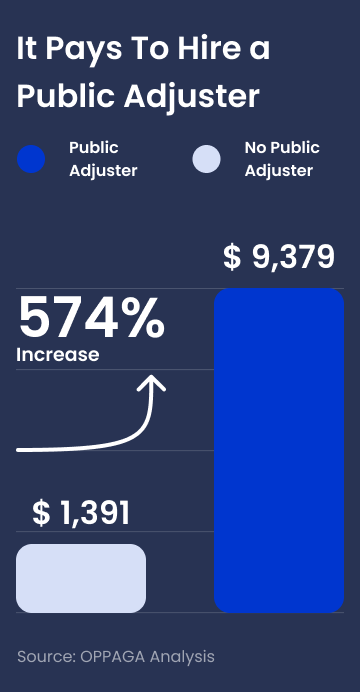

Furthermore, public adjusters can help maximize the settlement amount. Insurance companies aim to minimize payouts, and their adjusters may not always have the policyholder's best interests at heart. Public adjusters, on the other hand, work solely for the policyholder and are motivated to secure the highest possible settlement. They use their expertise to ensure that all damages are included in the claim and that the policyholder receives compensation for the full extent of their losses. This can make a substantial difference in the financial recovery after a hurricane.

In conclusion, hiring a public adjuster can provide significant benefits when submitting a claim for hurricane storm damage in Florida. Their expertise in damage assessment, policy interpretation, and negotiations can ensure that the claim is filed accurately and promptly. They can expedite the claims process, reduce stress, and maximize the settlement amount. For policyholders facing the daunting task of recovering from a hurricane, a public adjuster can be a valuable ally in navigating the complexities of the insurance claims process and securing the compensation needed to rebuild and recover.

Have PPA Advocate For You

We can professionally advise and navigate you through the entire claims prosses until get you the fair settlement you deserve.